NEW WASTE LAW AND LANDFILL TAX: HOW CAN THE WASTE SECTOR CHANGE? AN EXAMPLE…

NEW WASTE LAW AND LANDFILL TAX: HOW CAN THE WASTE SECTOR CHANGE? AN EXAMPLE…

26/05/2021

The new Spanish Waste Law includes, among many other things, the general introduction of a tax for the entry of waste to landfill. Well used, such a rate could completely change the management scheme, as has already happened in the United Kingdom. It is an interesting example that we can look at as a reference for the future. What happened there?

In 1996, a landfill tax was introduced in the UK, which was levied on every ton of waste that entered in a landfill. The objective was to penalize this form of disposal, to achieve two objectives: to reduce the total amount of non-recycled garbage, and to prevent this rejection from going to landfill. The landfill tax was considered “a popular tax”, so it was widely supported by local authorities, citizen organizations and industry stakeholders (it is often a “popular” tax the one people think that others are going to pay, not themselves, although in the end it is almost never true).

The new Spanish Waste Law includes, among many other things, the general introduction of a tax for the entry of waste to landfill. Well used, such a rate could completely change the management scheme, as has already happened in the United Kingdom. It is an interesting example that we can look at as a reference for the future. What happened there?

In 1996, a landfill tax was introduced in the UK, which was levied on every ton of waste that entered in a landfill. The objective was to penalize this form of disposal, to achieve two objectives: to reduce the total amount of non-recycled garbage, and to prevent this rejection from going to landfill. The landfill tax was considered “a popular tax”, so it was widely supported by local authorities, citizen organizations and industry stakeholders (it is often a “popular” tax the one people think that others are going to pay, not themselves, although in the end it is almost never true).

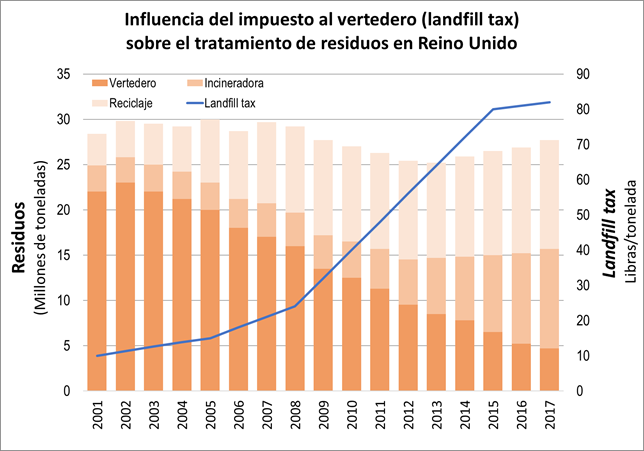

At first it was a moderate amount, about 5 pounds per ton. But it was increasing, little by little at the beginning and faster over the years, with an acceleration in the growth of the tax from 2009. By 2014 it was already at 70 ₤/t (about € 88 at the time), and it has stabilized above 80 ₤/t (90 €/t). To see the impact of such a tax, it is important to know that the cost of taking a ton of waste to landfill can range between 20-40 €/t. And the cost of incineration (with energy use), is rather between 90-120 €/t. What was happening? Well, taking a ton of waste to the landfill cost 40 €, plus a 90 € tax, a total of 130 €. So it was more expensive than incinerating it! The message was sharp clear.

The result was twofold. First, recycling increased (it is also much cheaper than incineration, 40-60 €/t). Second, there was strong pressure to get the no-longer-recoverable rejects to go to incinerators.

But there were none, the country did not have installed capacity for this. And an incinerator does not start up like a shoe store: they are important investments (100-200 million euros), they require an administrative concession to guarantee the entry of waste, they involve complex environmental approval procedures, and several years for their design, equipment manufacturing, construction and commissioning. So, suddenly, the landfill became very expensive but there were no alternatives. Many processes were put in place to get incinerators installed in different counties and cities as quickly as possible, but that took time.

Meanwhile, it was necessary to look for temporary solutions, for a few years. And what happened? Well, the rejection began to leave the United Kingdom on ships, addressing to incinerators on the continent with the capacity to eliminate it. Netherlands, Sweden and Germany were the main destinations, but also Norway and Denmark. All of them the closest countries with a large park of incinerators. And also with industrial consumption capacity, because the rejects did not come out as is, but transformed into SRF (Solid Recovered Fuel). So for years, and because of the landfill tax, it was cheaper in the UK to produce SRF from reject and export it by ship than to landfill it. Curious effect: Netherlands and Germany became the incinerator for the British.

Finish line: At the beginning of 2020, there were 53 incinerators in operation in the UK and 11 under construction, the fastest turnaround seen in the waste sector. It is considered that, with these plants, the need is covered and they are no longer needed. The amount of waste sent to landfill has decreased by 70% since 2000, and the recycling rate has gone from 18% to 44%. The ratio of waste to incineration has quadrupled, from 10 to 41%, and now that there is capacity in the country itself, waste exports are falling sharply.

In this case, increasing landfill tax rates sent a very strong message to all the players involved in recycling, and is helping the government meet its environmental goals. It must be clear that this tax does not come from the air: it means that treating waste is more expensive, and in the end it is paid by citizens with their taxes or fees. But it seems that, in general, they are satisfied with the result (or are unaware of it). Paying is not bad, the bad thing is paying for something that is not worth it, and sometimes it is worth paying a little more.

It must be said that the commitment to incineration, as a method to eliminate landfills, is accompanied in the United Kingdom by a solid policy to promote recycling, and the results are visible (the recycling rate is growing and is at 43%). Although it is not planned to modify the tax, it could serve in the future to further adjust the objectives, for example by penalizing emissions or subsidizing the recycling of organic matter. These possible fittings are now under discussion.

This is an example of a determined policy with clear medium-term objectives, which in just ten years has turned a landfill country into one with a truly advanced waste treatment mix. What will happen in Spain? Well, we will see.